Smart Moves in a Complex Market: How Investors Navigate New York’s Multifamily Landscape

What makes certain real estate investors consistently spot opportunities that others overlook?

It’s not luck. It’s not perfect timing.

Often, it comes down to understanding the rhythm of a market as layered and fast-moving as New York’s.

New York’s multifamily sector—stretching from Manhattan to Yonkers—has been showing a steady surge in search activity, from “yonkers apartment buildings for sale” to “multifamily brokers,” suggesting a rising curiosity among both seasoned and first-time investors. And somewhere between market research, financial modeling, due diligence, and negotiation, many investors eventually turn to specialized expertise like that provided by Multifamily Investment Real Estate Brokers In New York to help them navigate the sharp turns.

Why Multifamily Continues to Rise in Demand

The appeal of multifamily assets in New York stems from a familiar trio: stability, cash flow, and long-term appreciation. Even in fluctuating economies, demand for housing remains strong. Neighborhoods like Yonkers—where searches for places like “30 Post Street,” “119 Ludlow Street,” and “121 Ludlow St” are trending—signal continued investor interest.

Shorter lease terms compared to commercial properties also provide flexibility. Investors can make market-driven adjustments faster. And for many, the capacity to add value through renovations or better management makes the asset class even more attractive.

Some notable reasons the asset class keeps leading interest:

Reliable rent demand

Opportunities for repositioning and value-add improvements

Potential for portfolio scalability

Tax advantages through depreciation and 1031 exchanges

Some listings—such as Multifamily Investment Properties For Sale In New York or highly searched Multifamily Properties For Sale In New York—tend to move quickly because investors understand the long-term upside.

The Role of Brokerage Guidance in a Competitive Market

The multifamily market in New York is not just competitive—it’s nuanced. Zoning regulations, tenant protections, DHCR requirements, and evolving rent laws can create unfamiliar terrain for new investors.

This is where many rely on the support of Experienced Commercial Real Estate Brokers In New York who provide an extra layer of analytical insights, risk evaluation, and transaction structuring. They help investors dig beneath surface metrics and identify buildings that align with long-term financial objectives.

Trends also show growing interest in Yonkers, with frequent searches for “yonkers real estate brokers” and specific building addresses. Yonkers, with its commuter lifestyle appeal and expanding redevelopment zones, remains one of the region’s most targeted submarkets. Listings such as a Multifamily Building For Sale In Yonkers often attract investor competition quickly due to their relative affordability compared to the five boroughs.

Some of the key ways brokers create advantage:

Locating off-market deals

Performing property valuation and cash-flow modeling

Accessing reliable inspection, management, and lending networks

Negotiating terms that reduce risk and maximize yield

Ensuring compliance with local agencies like DHCR

And for investors exploring both stabilized and value-add options, the right brokerage partnership can be the difference between a well-performing purchase and a costly miscalculation.

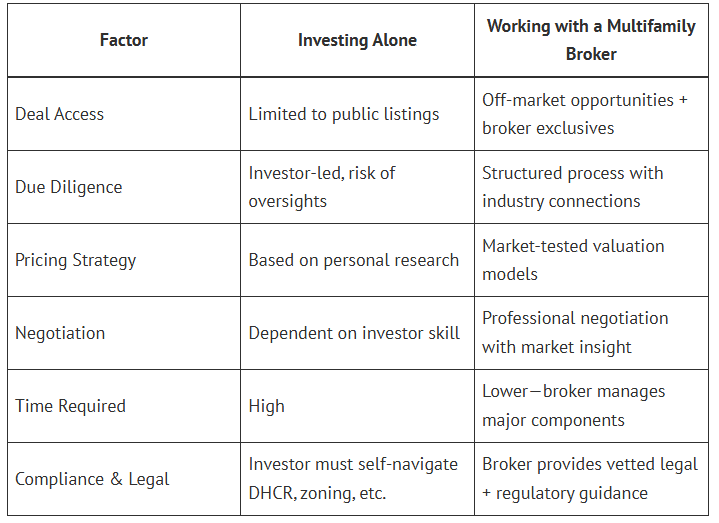

Comparing Investment Approaches: On Your Own vs. With a Broker

Below is a simple table to illustrate what investors often weigh when deciding between solo acquisition and working with specialized multifamily advisors.

Comparison Table: Independent Investing vs. Broker-Guided Investing

In the middle of long negotiations or while balancing tenant evaluations, many investors realize the deeper value of partnering with Multifamily Investment Real Estate Brokers In New York—professionals who manage complexities that can impact an asset’s profitability.

How New York Buyers Evaluate Multifamily Assets

Every building is a unique equation. What works for a 20-unit property in Yonkers may not apply to a 6-unit building in Brooklyn.

Most investors evaluate a mix of fundamentals:

Core Considerations

Location intelligence

Foot-traffic patterns, school districts, transit access, future development plans.Rent-roll health

Tenant payment history, lease structures, turnover risk.Expense load

Whether the building has updated HVAC, roofing, plumbing, or electrical systems.Regulatory framework

DHCR filings, rent stabilization status, maintenance requirements.Market trajectory

Submarket growth indicators such as job creation or municipal development projects.

These variables help investors differentiate a promising asset from one that looks good on paper but underperforms in reality.

Navigating High-Demand Submarkets

Investors have been especially active in areas with increasing online visibility. For instance:

Searches for “commercial real estate brokers near me” continue rising in multiple New York counties.

Searches for specific Yonkers addresses (“26 Post Street,” “121 Ludlow Street,” etc.) show investment focus on repositioning and redevelopment corridors.

Rising queries for “multifamily brokerage” imply more investors are ready to enter the acquisition phase.

The blend of shifting interest rates, demand for rental housing, and strategic neighborhood revitalization means the right purchase can carry significant upside.

In these cases, working with Experienced Commercial Real Estate Brokers In New York helps buyers understand which neighborhoods offer current value and which are long-term growth plays.

Mid-Article Keyword Placement

The guidance and layered understanding provided by Multifamily Investment Real Estate Brokers In New York often become essential once investors begin analyzing deeper deal structures, rent law impacts, and long-term positioning strategies.

Real-World Example: How Strategy Influences Portfolio Growth

Consider a hypothetical investor evaluating two properties:

Property A: A well-maintained 12-unit building in Yonkers with moderate rents and long-term tenants.

Property B: A 6-unit building in Upper Manhattan requiring significant upgrades.

On the surface, Property B promises higher returns due to value-add potential. But upon reviewing tenant protection statutes, renovation constraints, and projected operating expenses, the investor discovers that the Yonkers property—especially a Multifamily Building For Sale In Yonkers—may actually yield a more stable return over the next 10 years.

Without proper market insight, it’s easy to misjudge which asset is truly stronger.

Advantages of Structured Advisory During a Transaction

Most investors prefer predictable timelines and fewer surprises. The transaction support typically includes:

Financial model review

Lease audits

Inspection coordination

Lender introductions

Market comps and competitive positioning

Rent regulation verification

Broker-led guidance reduces deal uncertainty—critical in larger multifamily transactions.

Client Testimonials

They guided me through my first acquisition in Yonkers effortlessly. I didn’t know how many steps were involved. Having a brokerage team that understood valuation and DHCR requirements made all the difference. — J.R., Investor

Our multifamily building needed analysis beyond the basics. They helped us identify renovation priorities before closing and connected us with reliable contractors. — M.L., Property Owner

Frequently Asked Questions

What determines the value of a multifamily property?

Primarily rental income, expense efficiency, tenant stability, location, and potential for improvements. Investors also consider comparable sales and long-term market trends.

Are rent-stabilized properties worth buying?

They can be, especially for investors seeking long-term stability. But the legal framework is complex, making professional due diligence essential.

How long does the acquisition process usually take?

Anywhere from 45 to 120 days depending on financing, inspections, and regulatory checks.

What neighborhoods are trending?

Yonkers continues to trend based on search data and redevelopment activity, though demand remains high across all boroughs.

Can new investors succeed in the New York multifamily market?

Absolutely—provided they take time to understand regulations, financial modeling, and reliable property management planning.

Strategic Insight: What to Look for as You Expand

Growth-focused investors often prioritize:

Properties with under-market rents

Strong transit access

Buildings with deferred maintenance they can improve

Assets with supplemental income potential

Areas with growing employment hubs

Identifying these opportunities early often requires seasoned market visibility.

As investor interest continues rising—especially in trending categories like Multifamily Investment Properties For Sale In New York—competition for quality assets grows stronger.

Investors who navigate complex rent regulations, market cycles, and competitive neighborhoods frequently rely on Multifamily Investment Real Estate Brokers In New York to help them make decisions grounded in local expertise, financial discipline, and long-term strategy.

The Final Word on Today’s Market

New York’s multifamily landscape is dynamic, competitive, and rich with potential. Whether exploring redevelopment zones in Yonkers, scanning listings across the five boroughs, or evaluating properties like Multifamily Properties For Sale In New York, the right combination of data, expertise, and strategy helps investors outperform the crowd.

For those seeking grounded, market-informed guidance, NuRealty Advisors Inc. —with decades of brokerage and advisory experience—stands as one of the reliable names many investors trust across New York and beyond. Their team has long supported clients with valuation, due diligence, acquisitions, and dispositions, backed by analytical rigor and local understanding.

As you continue your search, whether you're evaluating a Multifamily Building For Sale In Yonkers or considering your next move in a different submarket, connect with a reputable advisor when you’re ready. It’s not about selling—you’re simply equipping yourself with clearer insight, stronger analysis, and smarter long-term positioning.

And as you evaluate your next steps, remember that many successful investors frequently rely on Multifamily Investment Real Estate Brokers In New York to help transform research into results.

Write a comment ...